lincoln ne sales tax 2019

There are no changes to local sales and use tax rates that are effective January 1 2022. The County sales tax rate is.

Pre Owned 2019 Toyota Tacoma Trd Sport 4 4 Trd Sport 4dr Double Cab 5 0 Ft Sb 6a In Roanoke Cj25340b Berglund Chevrolet Buick

025 lower than the maximum sales tax in NE.

. 800-742-7474 NE and IA. There is no applicable county tax or special tax. Shall the City Council of Lincoln Nebraska increase the local sales and use tax rate by an additional one quarter of one percent ¼ upon the same transactions within such municipality on which the State of Nebraska is authorized to impose a tax for a period of six years for street.

City of Lincoln Transportation and Utilities Created Date. Nebraska saw the largest decrease in sales taxes this year improving its combined state and local sales tax ranking by two spots. Visit the Avalara Nebraska state guide to learn more about sales and use tax in.

The Nebraska sales tax rate is currently. In Lincoln the local sales and use tax rate will jump. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

2019 Sales Tax 55. 2022 Nebraska Sales Tax Changes. What is the sales tax rate in Lincoln Nebraska.

In Lincoln another 15 percent or one and a. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements. A new 1 local sales and use tax is being imposed in the following locations bringing the total state and local rate in each to 65.

Raised from 55 to 725 Hershey Brady Maxwell Wellfleet and Dickens. Lincoln NE Sales Tax Rate. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. 8292019 82837 AM.

It was approved. There are no changes to local sales and use tax rates that are effective July 1 2022. The Nebraska state sales and use tax rate is 55 055.

1 the Village of Orchard will start a 15 local sales and use tax. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Ballot Question April 9 2019.

Lower maximum sales tax than 77 of Nebraska counties. Lincoln drove this change by decreasing its sales tax from 15 percent to 10 percent offsetting increases in a few smaller Nebraska municipalities. La Vista NE Sales Tax Rate.

ACT Meeting August 29 2019 - Summary of Potential Use of Quarter Cent Sales Tax for New Construction Subject. Nebraska sales tax rate change and sales tax rule tracker. The December 2020 total local sales tax rate was also 7250.

Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. Effectively Pender will not have a local sales and use. Review Nebraska state city and county sales tax changes.

A no vote was a vote against authorizing the city to increase the local. Local sales and use tax increases to 2 bringing the combined rate to 75. Over the past year there have been nineteen local sales tax rate changes in Nebraska.

Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on July 1 2019. Some cities and local governments in Lincoln County collect additional local sales taxes which can be as high as 15. 555 South 10th Street Room 110 Lincoln NE 68508 RE.

2019 Tax Increment Financing Report for the City of Lincoln In March of 2018 Governor Ricketts signed into law an amendment to the Nebraska Community. Hubbard is levying a 15 local tax bringing the. The Nebraska state sales and use tax rate is 55 055.

2019 Net Taxable Sales. Heres how Lincoln Countys maximum sales tax rate of 7 compares to other counties around the United States. New local sales and use taxes.

Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. For tax rates in other cities see Nebraska sales taxes by city and county.

However as a result of an affirmative vote in the November 6 2018 election Pender will impose a new city sales and use tax at the rate of 15 but it will not be effective until April 1 2019. 1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will collect a new 15. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

April 30 2020. The Nebraska sales tax of 55 applies countywide. The state capitol Omaha has a.

A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Lexington NE Sales Tax Rate. Did South Dakota v.

As of January 1 2019 Nebraska requires certain out-of-state businesses to collect and remit Nebraska sales tax. Of their total sales and will. Wayfair Inc affect Nebraska.

Lincoln on the Move. The Lincoln sales tax rate is. This is the total of state county and city sales tax rates.

You can print a 725 sales tax table here. A county sales and use tax is only imposed on taxable sales within the county but outside the city boundaries of any city that imposes a city sales tax. POTENTIAL USE OF QUARTER CENT SALES TAX FOR THE MINIMUM 25 FOR NEW CONSTRUCTION TO PROMOTE PRIVATE SECTOR INVESTMENT.

Lincoln NE Sales Tax Rate The current total local sales tax rate in Lincoln NE is 7250. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. McCook NE Sales Tax.

555 South 10th Street Suite 205 Lincoln NE 68508 402-441-7606 lincolnnegov DATE. 2020 Sales Tax 55. For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate.

The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent.

Anatomy Of An Artwork Untitled I Shop Therefore I Am 1987 2019 By Barbara Kruger Art For Sale Artspace

10136 Queensland Rd West Des Moines Ia 50266 Mls 600593 Zillow Ranch Homes For Sale House Colors Hardy Plank Siding

Used Certified Vehicles For Sale Pearland

2019 Honda Pilot Configurations Lx Ex Ex L Touring Elite Lincoln

Used 2019 Gmc Yukon Xl For Sale Near Me Edmunds

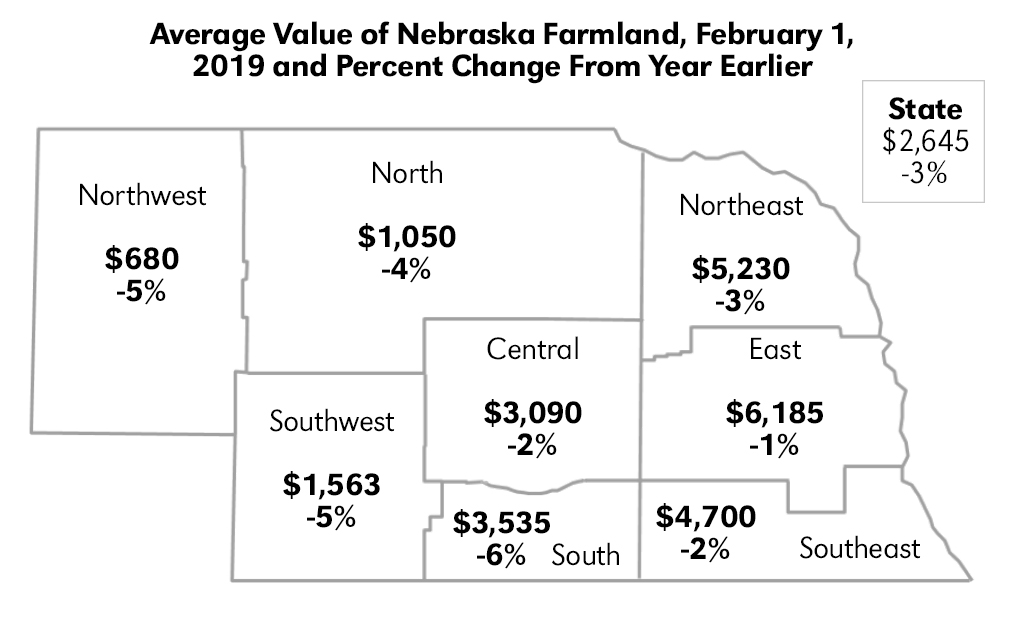

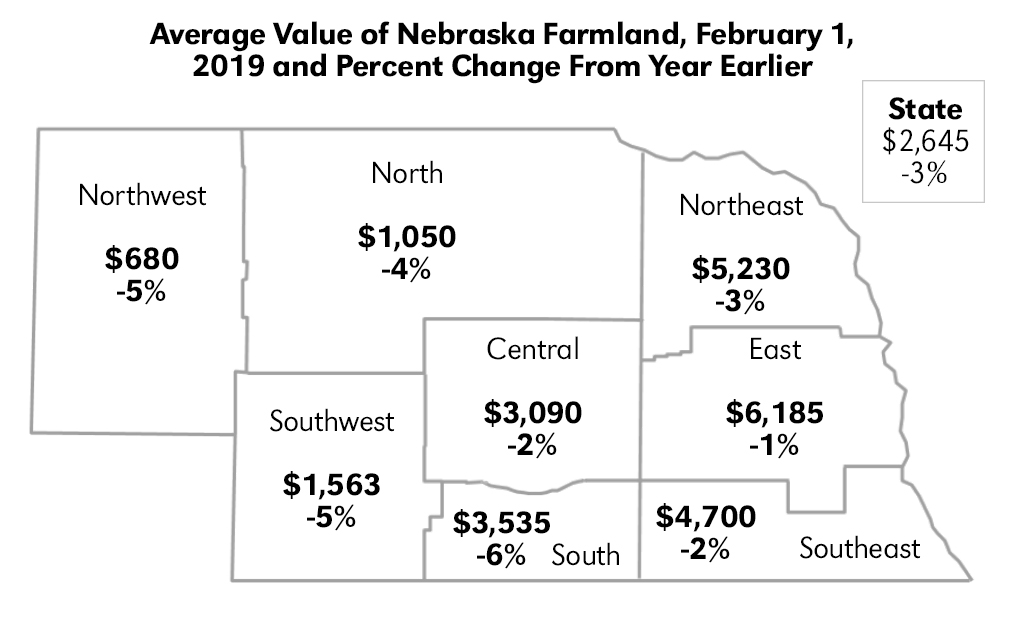

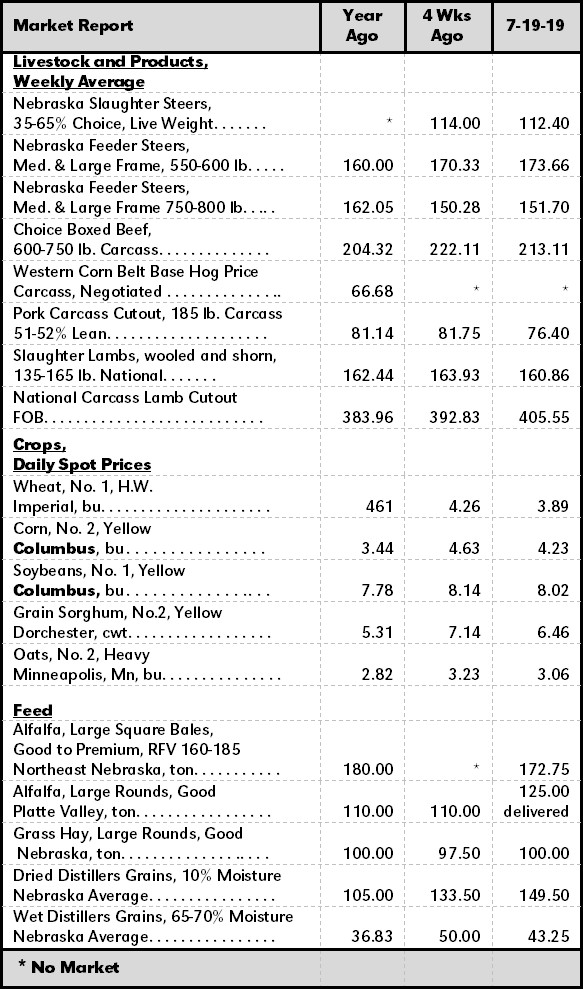

2019 Nebraska Farm Real Estate Report Agricultural Economics

Today S Ljs Is The Last Edition Printed In Lincoln Endofanera Signsofprogress Star Signs Instagram Prints

Used 2019 Gmc Acadia For Sale Near Me Edmunds

Vehicle And Boat Registration Renewal Nebraska Dmv

2019 Nebraska Property Tax Issues Agricultural Economics

Pre Owned 2019 Bmw X3 M40i Xdrive Awd Sport Utility In Miami Gardens B355962 Off Lease Only

Pre Owned 2019 Jeep Wrangler Unlimited Sahara Convertible In Bellevue 23614a Land Rover Bellevue

Certified Pre Owned 2019 Chevrolet Colorado 4wd Zr2 Crew Cab In Fremont 1t8858g Sid Dillon